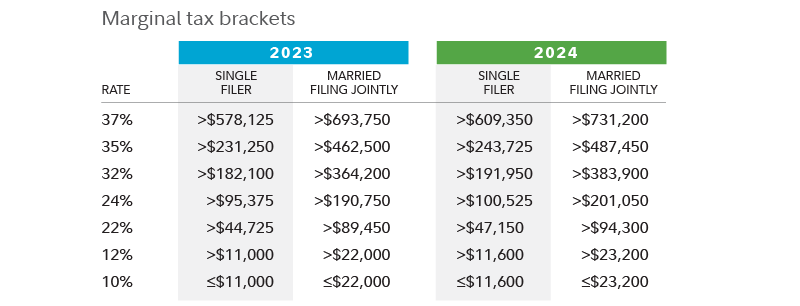

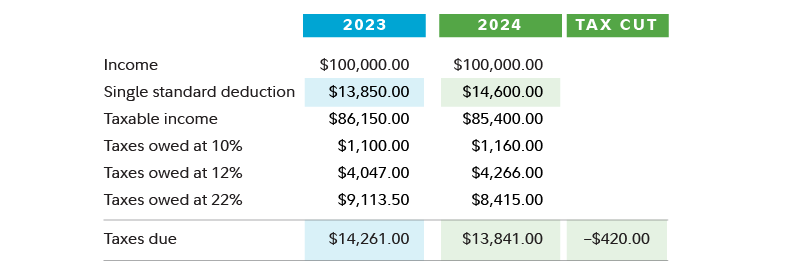

Federal Tax Brackets 2025 Chart Printable Pdf – For 2025, the standard tax deduction for single filers has been raised to $14,600, a $750 increase from 2023. For those married and filing jointly, the standard deduction has been raised to $29,200, . For both 2023 and 2025, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Below, CNBC Select breaks down the updated tax brackets of 2025 and what you need to know. .

Federal Tax Brackets 2025 Chart Printable Pdf

Source : www.cpapracticeadvisor.com

Tax brackets 2025| Planning for tax cuts | Fidelity

Source : www.fidelity.com

IRS Sets 2025 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

Tax brackets 2025| Planning for tax cuts | Fidelity

Source : www.fidelity.com

IRS Sets 2025 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

IRS: Here are the new income tax brackets for 2025

Source : www.cnbc.com

IRS Announces 2025 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

IRS: Here are the new income tax brackets for 2025

Source : www.cnbc.com

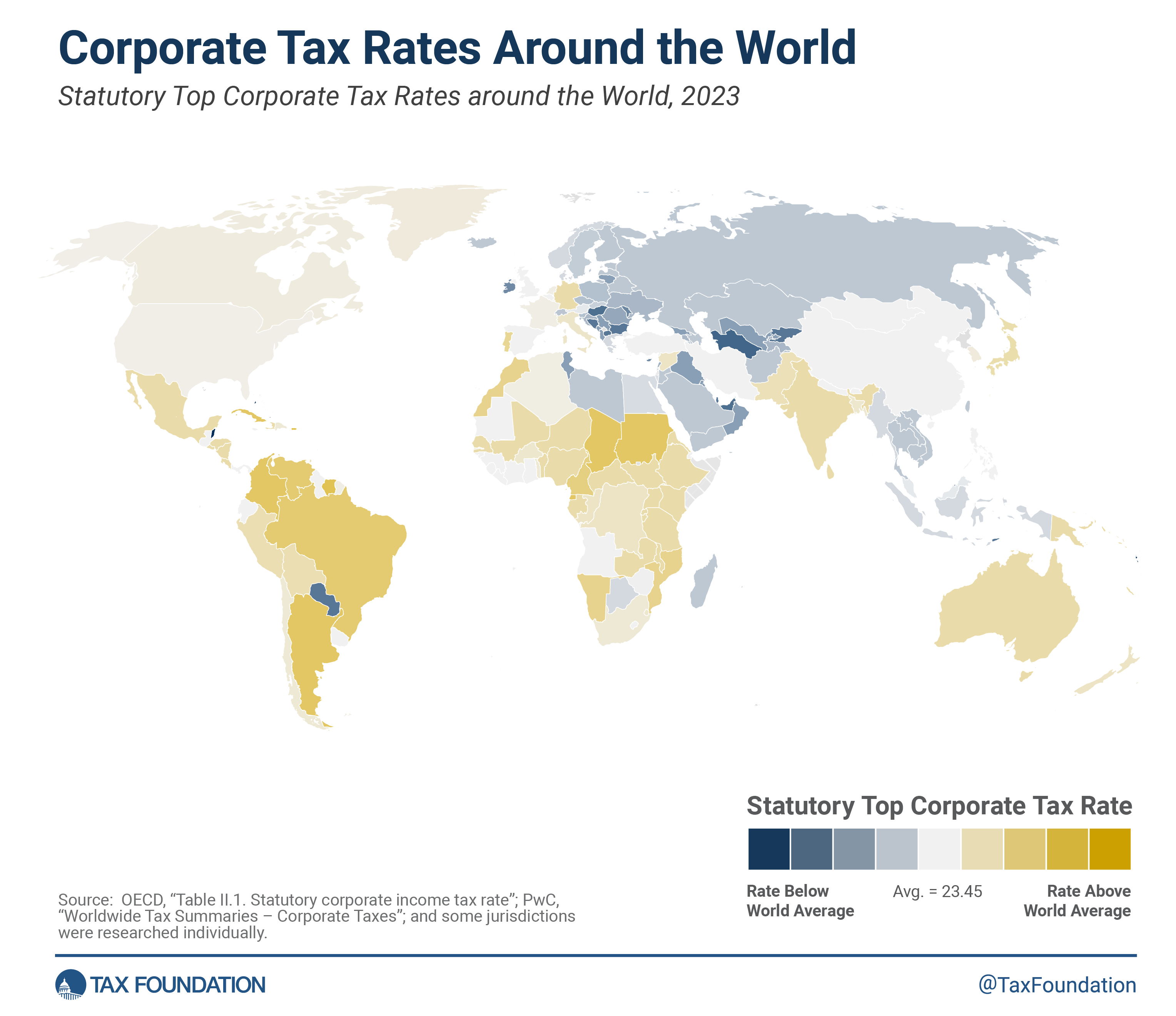

Corporate Tax Rates around the World, 2023

Source : taxfoundation.org

Tax Due Dates For 2025 (Including Estimated Taxes)

Source : thecollegeinvestor.com

Federal Tax Brackets 2025 Chart Printable Pdf Projected 2025 Income Tax Brackets CPA Practice Advisor: Tax brackets rise with inflation. The brackets for 2023, reflected on the tax return you will file in 2025, are slightly higher than the ones for 2022. A tax bracket is a tier of incomes subject to a . The federal tax rates themselves haven’t changed for the 2025 tax year. For both 2023 and 2025, the seven federal tax rates are 10%, 12%, 22%, 24%, 32%, 35%, and 37%.They’re not impacted by .